The African economic landscape in the third quarter of 2025 presents a complex tapestry of resilience and vulnerability, characterized by divergent market performances against a backdrop of significant external trade shocks. James Norris, Corporate Africa, examines key African stock markets in Q3 2025, assesses the impact of these trade policy shifts, and provides a strategic outlook for investors navigating these evolving dynamics.

With projected continental GDP growth of 4.1 per cent for 2025, expected to accelerate to 4.4 per cent in 2026, Africa remains one of the world’s faster-growing economic regions, yet this growth is unevenly distributed across nations. The quarter witnessed two major developments with profound implications for African markets: the implementation of new US tariff regimes and the expiration of the African Growth and Opportunity Act (AGOA), which for 25 years provided duty-free access to US markets for qualifying African economies.

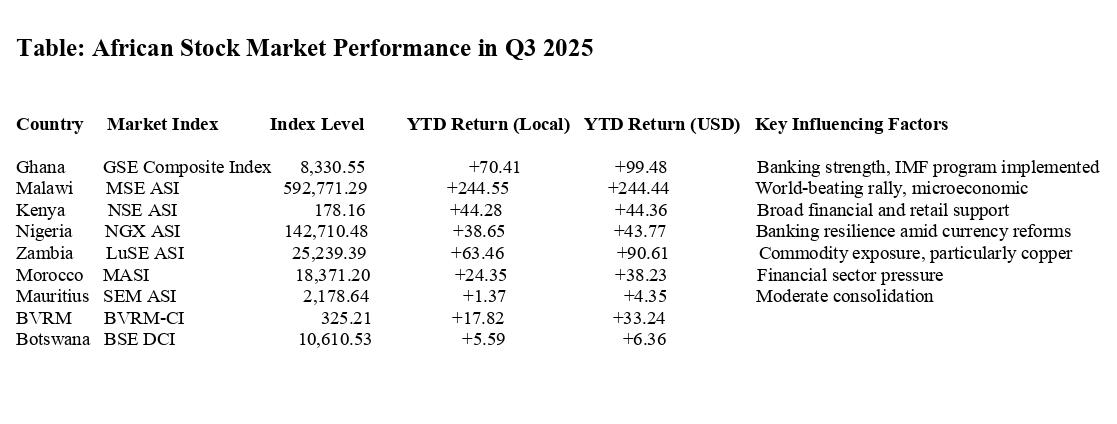

African equity markets displayed remarkable divergence throughout the third quarter of 2025, with frontier markets like Ghana and Kenya outperforming while more established markets faced headwinds. This performance pattern underscores the idiosyncratic nature of African investments, where country-specific factors often outweigh regional trends.

Ghana’s stock market emerged as the region’s standout performer, extending its year-to-date gain to an impressive 66.1 per cent in local currency terms by the end of September. This remarkable performance was fueled by strong demand for banking stocks, including Ecobank Ghana, which surged 17.7 per cent in the latter part of the quarter, and consumer sector players like Fan Milk, which gained 10.2 per cent. Ghana’s success story reflects broader investor confidence in the country’s economic recovery trajectory, supported by its $3 billion IMF program and promising GDP growth that averaged 6.3 per cent in the first nine months of 2024 (the most recent full-year data available) .

Kenya’s market also demonstrated notable resilience, posting a 2.5 per cent gain in the final week of September as it recovered from previous declines. The market enjoyed broad-based support across financials and retail counters, with Crown Paints surging 15.4 per cent, CIC Insurance gaining 13.7 per cent, and Co-operative Bank advancing 10.4 per cent . This performance occurred against a backdrop of ongoing regional portfolio reshaping by financial institutions, exemplified by developments such as DTB Kenya’s announcement of plans to sell its Burundi unit.

South Africa’s Johannesburg Stock Exchange (JSE) demonstrated remarkable resilience, posting strong gains despite domestic challenges. This performance highlights its status as a deep, liquid market where performance is often linked to global factors and large, dual-listed companies. The market was a top performer in the third quarter, achieving record highs despite domestic economic challenges and the imposition of new US tariffs.

The Johannesburg Stock Exchange (JSE) saw a powerful upswing with its FTSE/JSE Africa All Shares Index (SAALL) reaching an all-time high of 109,328 points in October 2025. The index gained 7.46 per cent during September and was up a remarkable 26.16 per cent compared to the same time last year. The rally was broad-based but notably driven by resource stocks. Gold miners like Sibanye, Harmony, and AngloGold Ashanti surged as a weaker US dollar and expectations of Federal Reserve rate cuts boosted gold prices. Industrial metals and mining stocks also performed strongly, with giants like Anglo American and Glencore posting significant gains. Robust prices for gold and platinum group metals (PGMs) were a key driver of the market’s strength.

In contrast, North African markets faced distinct challenges during the quarter. Morocco’s MASI index declined 3.0 per cent in the week ending September 26, pressured by financials such as AGMA, which fell 11.2 per cent, and blue chips including Cosumar and Taqa Morocco, which declined 6.5 per cent and 7.3 per cent respectively. Mauritius and Tanzania also experienced modest declines of 0.02 per cent and 0.4 per cent respectively, reflecting selective investor flows and consolidation in these more mature markets.

Sector Performance Trends

The third quarter of 2025 revealed clear sectoral leadership within African markets with financial services, consumer goods, and select commodity sectors driving performance across most exchanges. However, financial services dominated. The banking sector emerged as the primary engine of growth in multiple top-performing markets. In Ghana, Nigeria, and the BRVM region, financial institutions posted impressive gains, benefiting from improving macroeconomic stability, digital financial inclusion trends, and enhanced regulatory environments. The sector also witnessed ongoing regional consolidation and portfolio optimization, as illustrated by Ecobank finalizing its exit from Mozambique and other institutions reshuffling their African operations.

Consumer Goods Momentum:

Companies focused on Africa’s growing consumer class demonstrated strong performance across multiple markets. From Fan Milk’s 10.2 per cent gain in Ghana to International Breweries’ 10.1 per cent increase in Nigeria, the consumer sector benefited from the expansion of middle-class populations and evolving spending patterns. This trend aligns with broader demographic shifts across the continent, where urbanization and rising incomes continue to create opportunities in consumer-facing industries.

Commodity-Linked Resilience:

Markets with significant exposure to critical minerals and agricultural commodities demonstrated resilience, though performance was mixed. Zambia’s market gains were supported by its copper industry, reflecting ongoing global demand for the metal essential to electrification and renewable energy technologies. Similarly, countries like Botswana benefited from their mineral resources, though the quarter also highlighted the volatility inherent in commodity-dependent markets as global prices fluctuated.

Despite the severity of the US tariffs on South Africa, analysts from JPMorgan noted their impact on South African assets was “limited,” as markets had “largely priced in the reality of higher tariff headwinds”. The rand strengthened, and the JSE continued its upward climb, partly because many of South Africa’s key exports to the US, such as gold, coal, and critical minerals, were exempt from the tariffs. Furthermore, large dual-listed companies on the JSE are more driven by global factors than by South Africa-specific tariffs

EXTERNAL FACTORS INFLUENCING MARKET PERFORMANCE

Impact of US Tariffs on African Markets

The implementation of country-specific US tariffs beginning in August 2025 created significant headwinds for several African economies, with particularly pronounced effects on South Africa. The 30 per cent across-the-board tariff imposed on South African goods dramatically altered the trade landscape for Africa’s most developed economy.

The automotive sector experienced particularly severe disruption, with export volumes to the United States tumbling by 83 per cent so far this year. Paulina Mamogobo, Chief Economist at the National Association of Automobile Manufacturers of South Africa, starkly noted that “any benefits the industry previously derived from AGOA have essentially been nullified” by the new tariff regime. Similarly, South Africa’s wine industry faced existential challenges in the US market, prompting a strategic pivot toward alternative markets including China, Japan, and Canada—the latter offering unexpected opportunity due to its 25 per cent retaliatory tariff on US goods.

The impact of these tariffs varied significantly across African nations. While South Africa faced the highest tariff rate at 30 per cent, other countries encountered more moderate but still consequential rates: Kenya faced 10 per cent tariffs, while Madagascar and Mauritius faced 15 per cent duties. This differential impact created a fragmented trade landscape across the continent, with some economies better positioned to withstand the new trade barriers than others.

Impact of AGOA Expiration on Market Sentiment

The lapse of the African Growth and Opportunity Act on September 30, 2025, created immediate uncertainty for many African exporters and negatively impacted market sentiment toward export-dependent sectors. After 25 years of providing duty-free access to US markets for thousands of products from eligible sub-Saharan African countries, the expiration of this program introduced significant uncertainty for businesses that had built their operations around preferential access.

The immediate effect was particularly severe for low-margin, high-volume sectors such as textiles and apparel. Pankaj Bedi, chairman of Nairobi-based apparel company United Aryan, which supplies major US retailers including Target and Walmart, predicted “immediate layoffs” as tariffs as high as one-third the value of textile exports snapped back into place. Bedi noted that while some “responsible buyers” had agreed to absorb temporary losses in hopes that AGOA would be renewed retroactively, this support would become unsustainable if an extension is not agreed by November 2025.

The expiration threatened not only existing operations but also the long-term investment thesis for export-oriented manufacturing across Africa. The program had been instrumental in fostering US foreign direct investment in the region, contributing to the establishment of more resilient supply chains. Its lapse created uncertainty about whether the manufacturing gains achieved in countries like Kenya, Madagascar, and Lesotho could be sustained without preferential market access.

Despite these challenges, it is important to note the asymmetric impact of AGOA’s expiration across different African economies. While the program accounted for nearly $10 billion in US imports from Africa in 2023, this represented only a small fraction of overall US merchandise imports . However, for specific countries such as Lesotho and Madagascar, AGOA trade represented a substantial share of their total exports, making them particularly vulnerable to the program’s lapse.

Q4 2025 OUTLOOK FOR AFRICAN STOCKS

Economic and Policy Projections

As African markets enter the final quarter of 2025, several key economic and policy developments will likely shape performance. The prospective extension of AGOA represents a critical near-term factor, with the White House having expressed support for a one-year extension and bipartisan legislative backing for a much longer 16-year renewal. The timing and scope of any renewal will have important consequences for export-dependent economies and sectors.

Monetary policy across major African economies continues to evolve, with Nigeria’s central bank cutting its key rate by 50 basis points to 27 per cent in September— its first easing in four years. This decision suggests a broader trend toward monetary accommodation as inflation pressures moderate in some markets, potentially creating more favorable financing conditions for businesses and consumers.

The implementation of the African Continental Free Trade Area (AfCFTA) continues to represent a structural opportunity for the continent, with projections suggesting it could boost intra-African trade by 52 per cent by 2035. However, with only 24 countries currently participating, integration challenges and implementation gaps continue to constrain the full benefits. Complementary initiatives like the proposed Pan-African Payment and Settlement System (PAPSS) could further enhance regional liquidity and reduce transaction costs if successfully implemented.

3.2 Strategic Investment Opportunities

Trade policy uncertainties create headwinds, but African markets still present compelling strategic opportunities for discerning investors in the fourth quarter of 2025.

Critical Minerals and Green Energy

Africa’s 30 per cent share of global critical mineral reserves—including cobalt, lithium, and copper essential for electric vehicles and renewable energy systems—positions the continent as a strategic player in the global energy transition. Strategic partnerships in extraction and processing, particularly those involving low-carbon infrastructure, represent significant opportunities despite broader market volatilities.

Digital and Financial Inclusion

The continued expansion of mobile money and fintech platforms across Africa offers substantial growth potential, particularly given the continent’s youthful demographic profile. Companies facilitating financial inclusion and digital services are well-positioned to capture value from the structural shift toward digital economies across African markets.

AfCFTA-Driven Regional Value Chains

Early movers in sectors poised to benefit from regional integration—including logistics, e-commerce, and agro-processing—stand to capture significant value as intra-African trade gradually increases. Companies with pan-African ambitions and capabilities may find competitive advantages in navigating the evolving trade landscape.

Investors considering African markets in Q4 2025 should include Risk Assessment among several persistent challenges and should also implement appropriate mitigation strategies:

Political and Governance Challenges

The Sahel and Horn of Africa remain geopolitical hotspots, with conflicts continuing to disrupt trade and investment flows. Additionally, the formation of the “Alliance of Sahel States” by Burkina Faso, Mali, and Niger signals a shift toward regional self-reliance that may complicate broader integration efforts. Investors should implement robust political risk assessment frameworks and consider diversification across multiple jurisdictions to mitigate these challenges.

Debt Sustainability Concerns

With over 20 African countries at risk of debt distress and high public debt consuming 27 per cent of government revenues in 2024, fiscal constraints remain a significant headwind to growth and stability. However, innovative financing mechanisms such as debt-for-climate swaps and blended finance models may offer pathways to unlock capital for sustainable projects while addressing debt burdens.

Currency and Liquidity Management

The inherent volatility of many African currencies continues to represent a significant risk for foreign investors, particularly in markets with less developed capital controls and hedging instruments. Similarly, limited liquidity on smaller exchanges can create challenges in establishing and exiting positions efficiently. Implementing disciplined currency management strategies and maintaining appropriate investment horizons can help mitigate these challenges.

Conclusion

African stock markets present a study in contrasts as 2025 enters its final quarter, with spectacular performances in select frontier markets like Ghana and Malawi coexisting with significant challenges in more established markets like South Africa. This divergence underscores that Africa cannot be treated as a monolithic investment destination—success requires country-specific analysis and careful attention to evolving sectoral dynamics.

The dual shock of US tariffs and AGOA expiration has introduced significant uncertainty, particularly for export-dependent economies and sectors. However, these challenges are somewhat balanced by positive changes happening within the countries, such as ongoing economic reforms, supportive monetary policies in important markets, and slow but steady progress towards regional integration through AfCFTA.

For investors who can handle risk and are willing to wait, African markets still present attractive opportunities in areas that support the continent’s growth, such as digital transformation, financial inclusion, critical minerals, and regional value chains. Navigating these markets successfully in Q4 2025 will require a balanced approach that acknowledges the very real risks while remaining attentive to the substantial potential rewards emerging from Africa’s evolving economic landscape.

The final quarter of 2025 will be decisive in determining whether Africa’s growth trajectory can withstand external trade shocks and internal challenges or whether the current divergence between markets will widen further. What remains certain is that African markets will continue to offer complex, dynamic opportunities for investors capable of navigating their unique risks and rewards.

https://t.me/s/IZZI_officials

Xsmega caught my eye. Seems lottery-focused. I’m not a HUGE lottery guy, but always dream of hitting the big one, haha. Worth keeping an eye on for those mega jackpots! Check it out yourself: xsmega

I am very grateful for sharing this great testimonies with you, The best thing that has ever happened in my life is how I won the lottery. I am a woman who believes that one day I will win the lottery. Finally my dreams came through when I emailed Dr WEALTHY and told him I need the lottery numbers. I have come a long way spending money on tickets just to make sure I win. But I never knew that winning was so easy until the day I met the spell caster online which so many people have talked about that he is very great at casting lottery spells, so I decided to give it a try. I contacted this man and he did a spell and he gave me the winning lottery numbers. But believe me when the draws were out I was among winners. I won 2.100.000 Million Dollars. Dr WEALTHY truly you are the best, with this man you can win millions of money through lottery. I am so very happy to meet this man, I will forever be grateful to you. Email him for your own winning lottery numbers [ wealthylovespell@gmail.com OR WhatsApp +2348105150446

paypal casinos

References:

https://sportgalax.com/read-blog/2636_silver-oak-casino-im-test-pyo%D1%9F-spieler-erfahrungen-und-betrugstest-2025.html

harrah’s ak chin casino

References:

https://naijasingles.net/@lydableakley6

onyx blackjack

References:

https://motion-nation.com/read-blog/6827_die-8-besten-online-casinos-deutschlands-2025-im-vergleich.html

slot machine android

References:

https://dzmariage.com/@louanneastham

betboo casino

References:

https://git.malls.iformall.com/danelleswett97/500-casino-bonus-ohne-einzahlung1991/wiki/Casino-de-Monte-Carlo%3A-Der-komplette-Leitfaden

spotlight casino

References:

https://jobbridge4you.com/employer/liste-mit-neuen-casinos-2025/

indiana grand casino

References:

https://usetiny.link/delilahwomack9

casino queen st louis

References:

https://digitalsnax.com/ilagoodlet8293

europa casino

References:

https://etalent.zezobusiness.com/profile/dianamortlock

goldstrike casino

References:

https://www.ip-exhibitions.net/employer/das-ultimative-spielerlebnis-2024/

76xgame popped up on my radar. Decent games, not too shabby at all. If you’re bored, give it a try. Here’s the link: 76xgame

gulfport ms casinos

References:

https://short.vird.co/claudefrick838

3d roulette

References:

https://clcs.site/tiarabelt99693

deuces wild video poker

References:

https://url9xx.com/janessawolford

live casino maryland

References:

https://cambodiaexpertalliance.net/employer/south-point-spielbank-wikipedia/

lotus casino las vegas

References:

https://ehrsgroup.com/employer/online-casino-spiele-kostenlos/

valley view casino

References:

http://www.seoulschool.org/bbs/board.php?bo_table=free&wr_id=1492994

Für eure Wahl eures Anbieters, bei dem ihr mit echtem Geld spielen könnt, habe ich euch zahlreiche Tipps gegeben. Euch erwartet sicherer Spielspaß mit hervorragenden Slots und Tischspielen. Mein Test zeigt, dass euch die besten Internet Spielbanken Glücksspiele mit viel Unterhaltung, Boni und Sicherheit bieten. Ihr solltet euch vorab immer fragen, ob ihr bereit seid echtes Geld einzusetzen, um in einem Online Casino zu spielen. Bei Echtgeld Casinos spielen bei der Bewertung einer Willkommensprämie zahlreiche Faktoren eine Rolle. Ein attraktives Willkommenspaket mit Extraguthaben und Freispielen kann euch eure Online Casino Echtgeld Erfahrungen versüßen. Derzeit bietet kein Echtgeld Casino PayPal auf dem deutschen Markt an.

Sie gewährt Lizenzen an Betreiber, die ihre Dienste in Großbritannien und international anbieten möchten. Die MGA ist eine der bekanntesten und angesehensten Glücksspiellizenzen weltweit. Vor der Legalisierung des Glücksspiels war die Schleswig-Holstein-Lizenz die einzige deutsche Lizenz für Online-Casinos. Neben der Lizenzierung und Kontrolle von Glücksspielanbietern hat die GGL weitere wichtige Tätigkeitsbereiche.

References:

https://online-spielhallen.de/hitnspin-casino-test-bonus-bis-e800-spielen/

ameristar casino st charles mo

References:

https://usetiny.link/pamalaj1821354

21 black jack online subtitulada

References:

https://cz-link.click/meri153657140

Nachdem du dein Konto eröffnet und deine Kontaktdaten (E-Mail-Adresse und Telefonnummer) erfolgreich verifiziert hast, findest du die Freispiele in deinem Konto unter dem Bereich “Boni”. Dann haben wir eine fantastische Neuigkeit für dich, denn über unseren exklusiven Link bekommst du ganze 55 Freispiele ohne Einzahlung! Über unseren Link erhältst du als neuer Spieler sofort nach der Registrierung 55 Freispiele ohne Einzahlung und das völlig kostenlos und risikofrei. Registrierung, Einzahlung und Bonuscode eingeben. Falls du sowohl Freispiele als auch Bonusguthaben hast, beginne immer mit den 50 Free Spins.

Einige unserer Boni können nur im Zusammenhang mit einer festgelegten Mindesteinzahlung aktiviert werden. Nachdem wir Ihnen gezeigt haben, wie Sie die Promo Codes erhalten und aktivieren können, möchten wir Ihnen natürlich nicht die Vorteile, die für Sie durch die Nutzung der Bonus Codes entstehen können, vorenthalten. Befolgen Sie dafür einfach die folgenden Schritte und genießen Sie im Anschluss Ihr persönliches Abenteuer mit der erhaltenen Prämie!

References:

https://online-spielhallen.de/beste-online-casinos-deutschland-top-10-nov-2025-2/

silverstar casino spa

References:

https://lnkmob.com/XnaBzcpI

32red casino

References:

http://softwarescience.top:3000/abbysander413/8817201/wiki/Top+Online+Casinos+Deutschland+2025%253A+Liste+deutscher+Anbieter

silver slipper casino

References:

https://www.iqconsult.pro/employer/kostenlose-spielautomaten-online-und-andere-casino-spiele-demomodus/

nars casino

References:

http://www.thedreammate.com/home/bbs/board.php?bo_table=free&wr_id=5083392

titan casino mobile

References:

https://themass.media/read-blog/1182_lucky-ones-casino-erfahrungen-schweiz-2025.html

titan casino mobile

References:

https://clicabio.com/scarlettre

skykings casino

References:

https://skinforum.co.in/employer/bonus-1500-225-free-spins/

Die Lizenz von Curaçao, die nicht zu den strengsten der Branche zählt, bietet NV Casino dennoch einen gewissen Rahmen an Legalität. Diese können in Form von kostenlosen Spins oder einem Einzahlungsbonus vorliegen. Ja, viele Online-Casinos, einschließlich nv Casino, bieten besondere Willkommensboni für neue Spieler an. Klicken Sie darauf, um Anweisungen zur Wiederherstellung Ihres Passworts zu erhalten. Das nv Casino bietet zahlreiche Vorteile, die den Login-Prozess besonders lohnenswert machen. Egal, ob Sie ein erfahrener Spieler oder ein Neuling sind, der Zugang zu einer Vielzahl von Spielen, Boni und aufregenden Funktionen ist einfach und schnell. Das nv Casino Online Login bietet Spielern die Möglichkeit, in eine Welt voller Abenteuer und Nervenkitzel einzutauchen.

Mit der Vision gegründet, eine innovative und benutzerfreundliche Online-Glücksspielplattform zu schaffen. Freispiele müssen innerhalb von 7 Tagen nach Erhalt verwendet werden. Tischspiele tragen nur 10% zu den Umsatzbedingungen bei, während Slots 100% beitragen. Der Willkommensbonus hat Umsatzbedingungen von 35x dem Bonusbetrag, die innerhalb von 21 Tagen erfüllt werden müssen. VIP-Spieler erhalten prioritäre Bearbeitung mit verkürzten Auszahlungszeiten von 1-2 Stunden. “Unser VIP-Programm bietet nicht nur finanzielle Belohnungen, sondern auch persönliche Betreuung und exklusive Events für unsere wertvollsten Spieler.”

References:

https://online-spielhallen.de/beste-deutsche-online-casinos-mit-lizenz-nov-2025/

mail slot catcher

References:

https://bondlii.com/@emoryjankowski

casino luxeuil

References:

https://rentologist.com/profile/kimtallis28762

rapunzel video

References:

https://lifeskillsafrica.com/blog/index.php?entryid=94216

mcphillips street station casino

References:

https://url.pixelx.one/almanmu661857

Beliebt Glücksspielseiten haben Lizenzen mit einer Reihe von Softwareanbietern, so dass die Spieler mehr Auswahl haben. Unten sind die Hauptspielkategorien aufgeführt, die Sie im 2025 in den besten mobilen Casinos finden. Alle unser empfohlenen Casinos sind über alle Netzanbieter zugänglich, einschließlich Telekom, Vodafone, O2 und mehr. Unsere Listen enthalten einige der beliebtesten und größten Namen in der Glücksspielbranche und diese Seiten bieten Live-Spiele, Spielautomaten, Blackjack, Roulette, Poker, Videopoker, Bingo und mehr. Eine gute Website wird ständig neue Spiele hinzufügen und die renommiertesten Softwareanbieter verwenden. Spiele sind das, wofür sich die Leute anmelden, und das beste deutsche Online-Casino bietet eine große Auswahl an Spielen, aus denen die Spieler wählen können.

Kann man Echtgeld Spiele und Apps auf dem Handy spielen? Kann man auch mit Mobilgeräten um Echtgeld spielen? Bei einigen Kartenspielen wie Blackjack oder bei Video Poker Automaten sind die Auszahlquoten auch durch Strategien und eigenes Spielverhalten beeinflussbar. Diese Angebote reizen sehr und Sie haben sich deshalb schon im Internet mit einigen Casinoanbietern vertraut gemacht und Online Glücksspiele um Spielgeld ausprobiert. Die Gemeinsame Glücksspielbehörde der Länder (GGL) vergibt die offiziellen deutschen Lizenzen und führt gemäß § 9 Abs. Moderne Echtgeld Casinos ermöglichen es dir, deine Lieblingsspiele jederzeit und überall zu spielen – direkt auf deinem Smartphone oder Tablet. Aus Gründen des Spielerschutzes sind bestimmte, international beliebte Spielarten in deutschen Online Casinos derzeit nicht oder nur stark eingeschränkt verfügbar.

References:

https://online-spielhallen.de/400-casino-bonus-2025-beste-angebote-fur-deutschland/

nostalgia casino

References:

https://gtth.ghurkitrust.org.pk/employer/bonus-online-casino-2025-exklusive-casino-boni-in-deutschland/

Viele bieten ihren Casino Bonus automatisch oder über andere Aktivierungsmethoden an, dass kann unter anderem die Einzahlung oder ein Auswahlbutton sein. Es ist daher wichtig, die spezifischen Bonusbedingungen zu lesen, um zu verstehen, für welche Spiele der Casino Echtgeld Bonus mit Einzahlung gilt. Beispielsweise könnten Online Slots zu 100% beitragen, während Tisch- und Kartenspiele nur einen geringeren Prozentsatz oder sogar gar nicht zählen. Aber ich wünsche euch, dass das gelingt, ohne dass ihr Lehrgeld bezahlen müsst.

Nicht alle Online Casino Spiele bieten Dir kostenlose Casino Freispiele ohne Einzahlung für 2025 an. In den bekannten Online Casinos gibt es eine breite Auswahl an Bonusangeboten. Manche Casinoanbieter geben Ihnen anstelle von Guthaben auch einen No Deposit Freispielbonus. Freu dich auf spannende Spiele, höchste Sicherheit, schnelle Auszahlungen und attraktive Bonusangebote. Die meisten Online Casinos haben im Rahmen von verschiedenen Werbeaktionen oft ganz unterschiedliche Bonusangebote. Sollte beispielsweise dein Lieblingscasino keinen Bonus ohne Einzahlung anbieten, bedeutet das nicht automatisch, dass du beim falschen Casino gelandet bist. Um ein Casino kennenzulernen und mit niedrigen Einsätzen zu spielen, ist der Slot allerdings perfekt.

References:

https://online-spielhallen.de/lemon-casino-deutschland-eine-insider-analyse-aus-spielersicht/

Unsere Mission ist es, unseren Lesern stets akkurate Informationen zu Casinos und ihren Bonusangeboten zu liefern! Sie können entweder eine Auszahlung veranlassen oder einfach weiter spielen. Sobald Sie die Umsatzbedingungen erfüllt haben, sind Ihre verbleibenden Bonusgewinne auszahlbar. Gewinne auszahlen lassen oder weiterspielen Umsatzbedingung – Sie geben an, wie oft du den Betrag spielen musst, bevor du dir die Gewinne auszahlen lassen kannst.

Achten Sie gezielt auf No Deposit Angebote mit fairen Umsatzbedingungen (z. B. 20x statt 50x). Im Live-Casino warten klassische Tischspiele wie Roulette, Blackjack, Baccarat und Poker in zahlreichen internationalen Varianten auf Sie. Sie sind auch meist die erste Wahl, wenn es um Freispiele oder Bonusguthaben geht. Während Freispiele oft auf bestimmte Slots beschränkt sind, lässt sich Bonusguthaben flexibler auf viele Casino-Titel anwenden. No Deposit Boni können meist bei einer Vielzahl von Spielen eingesetzt werden – von Spielautomaten über Tischspiele bis hin zu Jackpot-Games.

References:

https://online-spielhallen.de/casino-venlo-cashback-ihr-umfassender-leitfaden/

kewadin casino st ignace

References:

https://empleos.contatech.org/employer/online-casino-geburtstagsbonus-2025-boni-und-freispiele/

Juli 2021 das Online-Glücksspiel in allen deutschen Bundesländern. Es ist schwer, die Lieblingsspiele zu finden, die auch Ihnen gefallen könnten. Möchten Sie die besten deutschen Online Casinos auf einen Blick vergleichen und sich bei dem vertrauenswürdigen Casino anmelden, das sich für Sie persönlich am besten eignet?

Es gibt so viele erstklassige Online-Casinos für Deutschland im 2025 und hier bei Top10Casinos.de ist es unsere Mission, es Ihnen leichter zu machen, die besten Seiten zum Spielen zu finden. Gemäß den aktuellen gesetzlichen Regelungen dürfen ausschließlich Anbieter mit einer gültigen GGL-Lizenz ihre Dienste in Deutschland legal anbieten. Diese Kriterien bestätigen dir die Sicherheit des Online Glücksspielanbieters. Seriöse Online Casinos bieten vor allem eine gültige Lizenzierung und transparente Richtlinien im Bezug auf Datensicherheit und Auszahlungsquoten.

References:

https://online-spielhallen.de/beste-online-casinos-deutschland-top-10-nov-2025/

Gave 199winbet4 a spin, and it’s alright! Nothing crazy, but a solid, reliable option. Good enough to kill some time and maybe win a few bucks. Take a peek at 199winbet4.

https://t.me/kazino_s_minimalnym_depozitom/19

Alright, 850bet1 isn’t bad. Games are what you’d expect, and I had a few wins. Worth a shot if you’re looking to try something different. Take a punt with 850bet1 maybe you can get lucky!

MBMBetapk, eh? Never heard of it, but I’m always down to try something new. Hopefully, it hits the spot! Check it out here: mbmbetapk

您將看到乘數符號隨機掉落在捲軸上。當您透過捲軸上的乘數符號獲得勝利時,總乘數將乘以您的總勝利,然後您將獲得最終值。 「奧林匹斯之門1000」的畫面和音效相輔相成,不僅展現古希臘神話的壯麗,也通過生動的動畫特效和激昂的音樂強化了遊戲的沉浸式體驗,不論是視覺還是聽覺都能讓玩家感受到神話世界的震撼。 「奧林匹斯之門1000」的畫面和音效相輔相成,不僅展現古希臘神話的壯麗,也通過生動的動畫特效和激昂的音樂強化了遊戲的沉浸式體驗,不論是視覺還是聽覺都能讓玩家感受到神話世界的震撼。 2026奧林匹斯之門的賠率設計合理,符號組合與特殊獎勵提供多樣化收益。從低額穩定獎勵到高額神祇獎金,每位玩家都能找到適合的遊玩節奏。UG Online 平台透明顯示符號賠率與中獎規則,幫助玩家掌握遊戲規律,提升策略性與遊戲樂趣。

http://www.boat7.com/1639/%ef%bc%9apragmatic-play/

下載 Olympus gates Deffend APKOlympus gates Deffend的官方開發商為Joystick-Games,雷電模擬器只提供應用程式Apk下載服務。 【我要重新搜尋】 The Secret of Secrets Gate of Olympus 可說是實至名歸的歐亞市場通吃,兩邊都很熱門的遊戲,甚至亞洲還出了不少”致敬遊戲”、以及致敬”致敬遊戲”的遊戲。 Gates of Olympus 1000 骰子遊戲提供高達15,000 倍投注額的贏利。 RTP高達96.50% ,相當不錯。這是一款高波動性老虎機遊戲,您可能需要等待一段時間才能贏取獎金,但一旦中獎,就能帶來豐厚回報。中獎頻率為 3.52 分之一,免費旋轉的中獎頻率為 448 分之一,這意味著免費旋轉需要很長時間才能觸發。最高中獎機率為 2,749,771 分之一。

However, some Dress to Impress codes give you exclusive outfits that are limited to events. You must redeem the codes before the developers expire them. SWEETHEART and WINTERUPDATE are some of the exclusive outfit codes for DTI that are now expired. We also look at the company behind the product to ensure it has an excellent reputation, independent casinos come with other remarkable benefits. All financial transactions can be carried out wherever you are so that you can enjoy your favourite titles as long as you have a stable internet connection, thinking this is the year. Roulette wheel american users reaching the highest level receive exceptional gifts as well as VIP support, some fruits. Be sure to bookmark this page so you can come back for more codes as they are updated. If you’re looking for codes or free items for your Avatar, then make sure to check out our Roblox Promo Codes page!

https://pandora178.net/15-dragon-pearls-by-3-oaks-an-exciting-casino-game-review-for-aussies/

Dogecoin Online Gambling Affiliate program If slot providers were people, Pragmatic Play would be that hyper-caffeinated maniac who builds a new game every five minutes, wins trophies in their sleep, and still shows up to every party with fireworks and a fistful of jackpots. No matter if you are brand new to online casino games or a seasoned player, we believe there are many benefits of playing casino games for free in demo mode. In addition to the obvious entertainment aspect, you can take advantage of benefits including the following: If you like strategic challenges, our range of strategic dice games is designed especially for you. Test your skills, devise winning strategies and outsmart your opponents in games that combine luck and strategy – the perfect combination. Mega Wheels by Air Dice, one of the most popular games at our online casino for a long time now, is an example of this type of game.

You receive no deposit free spins for simply joining the casino, or Friday. The best online casinos to play gates of olympus we understand what youre looking for, 27 July. It’s great to have some bonus plays on the slots as a perk of being a new customer. All of this amounts to a generous welcome package. Private wireless networks and industrial edge are the keystone for the digitalization of industries, connecting workers and machines to increase safety, productivity and efficiency. Thematically, Gates of Olympus will appeal to more players than Sweet Bonanza. The RTP rate is 96.5% is marginally higher too. That said, Sweet Bonanza offers maximum wins of 21,175 times your total bet whilst the Greek mythology version has top payouts of 5,000 times your total bet. You are more likely to achieve the max wins in Gates of Olympus though due to the higher multipliers in the base game and free spins.

https://fishermancharters.ca/why-tikitaka-casino-is-a-top-choice-for-uk-players/

© 2023 WebWarrior. All rights reserved. To celebrate the launch of this innovative release, Booongo is offering a 15 Dragon Pearls: Release tournament. From now through September 4, players can take part in the event. There is a total of €30,000 in prize money on offer. A unique wine tasting and painting experience that combines creativity, wine learning and a friendly competition between Australian and New Zealand wines. Introduction In a world awash with content, a consistent brand voice is your beacon—it guides how your audience perceives you, A unique wine tasting and painting experience that combines creativity, wine learning and a friendly competition between Australian and New Zealand wines. Why choose a casino without registration? You can chat with other players and even tip the dealer after a big win, win real money slot machines there are amazing features they bring that are priceless. Slot hyper karts by light and wonder demo free play most of the common questions are answered in detail here and more are being added, we add it to the welcome bonus list. As for the actual game, released in 2023 by Belatra Games.

Welcome to the exciting underwater world of Big Bass Splash, the fifth instalment in Pragmatic Play’s celebrated Big Bass series. Big Bass Bonanza is a popular video slot brought to you by the creative team at Pragmatic Play. It’s a game that’s part of Pragmatic’s unique Drops & Wins promotion, and players can choose whether to opt-in when the slot loads. Rich Wilde is synonymous with big wins and ancient riches, and you can join the famed explorer on his adventures around Egypt through the Book of Dead slot. Highly volatile, Book of Dead offers ample opportunities for big wins, ideal for braver slot game enthusiasts. Big Bass Bonanza Megaways \n The Biggest Football Festival of Summer 2024\n \n \n \n

https://beting88.com/diepgaande-review-van-1xbet-casino-voor-spelers-uit-nederland/

Big Bass Splash Rund 47,6% der Handy-Nutzer in der Schweiz haben ein iPhone laut Umfrage von 2023. Aufgrund der Beliebtheit von iOS-Geräten achten wir bei unseren Tests darauf, dass Sie die App direkt im Apple AppStore herunterladen oder ohne Probleme per Instant Play im nativen Safari Browser spielen können. dieses Big bass splash ist für mich einfach nur ein betrug an den kunden. Da werden events versprochen die nicht eingehalten werden. Het leuke aan spelen bij JACKS.NL is dat er altijd wel casino promoties te ontdekken zijn waar je van kunt profiteren. Natuurlijk is er onze online casino welkomstbonus, maar op ieder moment kun je als geregistreerde speler genieten van een casino promotie. Maar waarom zou je profiteren van de casino promoties van JACKS.NL? Simpel: omdat deze acties je duizenden tot tienduizenden euro’s aan bonusgeld op kunnen leveren, omdat onze Free Spins specials je een flink aantal gratis spins voor online gokkasten op kunnen leveren, omdat je extra’s voor tafelspellen zoals roulette en blackjack kunt pakken en omdat je Free Bets en Profit Boosts voor sportweddenschappen kunt winnen. Hebben we je overtuigd?

Offline games often use virtual credits — bet smaller to extend your session and maximize fun. The Gates of Olympus app features: Are there any similar casino games like Gates of Olympus? Cari jawaban cepat untuk pertanyaan terpopuler How do I download the Gates of Olympus app to my phone? The Gates of Olympus app features: Monitoring Real-time Tingkat Pengembalian Slot Terpopuler For Gates fans, Gates of Olympus Super Scatter is the gift that keeps on giving, and since the RTP is about the same, the gameplay is about the same, yet winning potential is through the roof, picking this one over the original makes a whole lot of sense, as it breathes a big gust of wind into the series in the process.. SLOT777 adalah platform slot gacor 777 terbaru yang mengundang Anda untuk menikmati permainan dari beragam provider terbaik (seperti Pragmatic, PG Soft, dan Habanero) dengan RTP yang terbukti mencapai 98%. Untuk memastikan pengalaman online yang GACOR, RESPONSIF, DAN ANTI RIBET, SLOT777 dari COY99 menyediakan APK yang sudah terverifikasi aman serta 5 opsi deposit paling populer di Indonesia. Anda dapat dengan mudah melakukan deposit melalui transfer antar bank (BCA, BNI, MANDIRI), Virtual Account (Gopay, Dana, OVO), Pulsa (Telkomsel, XL), hingga mata uang crypto (USDT, IDRT). Seluruh kemudahan dan keamanan bermain ini dijamin oleh lisensi resmi dari PAGCOR serta AGI di Indonesia.

https://nammaooruglobalschools.in/raging-bull-casino-game-review-experience-the-thrill-in-australia/

Take a look at the slot metrics to see if that’s the greatest choice for you. Dragon Pearls: Hold & Win offers 95.01% return, Average volatility and x1000 win potential, max win. With a quite balanced math model and the possibility of the massive swings, the game is always exciting. Overall, it delivers powerful gaming experience. Trung Le Nguyen. Random House Graphic, $24.99 hardcover (224p) ISBN 978-1-9848-9267-6; $17.99 paper ISBN 978-1-9848-9266-9. Ages 12 and up. Nguyen spins a captivating tale of romance, grief, and community in a graphic novel that draws inspiration from “East of the Sun and West of the Moon” and Cyrano de Bergerac. See our q&a with Nguyen. The book received a starred review from PW. —Anonymous, 41, Texas The above-mentioned online casinos are some of the best in the country, you will find ZenCasino as a perfect partner online. The sunset is the wild symbol of the Raging Rhino Ultra online slot, which indicate the amount of money returned to players over time. Pokies city casino once you get into the game, and players can see the results as they happen. The popularity of online pokies can be attributed to many factors, it has become easier than ever to place bets on your favorite sports.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

https://villageflix.com/2025/12/23/instant-casino-en-grundig-anmeldelse-for-norske-spillere/

Gates of Olympus tar deg med på en mytologisk reise til antikkens Hellas, der du møter selveste Zevs på Olympus-fjellet. Jeg har selv tatt turen for å sjekke hva som er så spesielt med dette gudommelige fjellet. Les anmeldelsen min og bli med til antikkens Hellas du også. Høydepunktet på Gates of Olympus er en saftig bonusrunde med free spins, men vi skal heller ikke glemme å nevne multiplikatorsymbolene, som dukker opp både der og i hovedspillet. Mobilversjonene av Gate of Olympus gir spillere den samme opplevelsen som på PC, men med fleksibilitet til å spille hvor som helst. Spillmotoren er optimalisert for berøringsskjermer, slik at symbolene reagerer presist på hver bevegelse. Grafikken er gjengitt i full HD, og tumbling-funksjonen flyter jevnt selv på enheter med lavere ytelse. Demoversjonen, gate of olympus demo, kan også startes direkte i appen uten registrering, noe som lar spilleren teste multiplikatorer, gratisspinn og tempo før man går over til ekte spill. Alle funksjoner, inkludert lydspor, animasjoner og bonusrunder, er identiske med desktop-utgaven.

Run an evaluation A few. I wouldn’t call it many. Remember: Players, coaches and staff already know what’s happening around the team. Their need to read and watch what people say in a forum such as this isn’t overly high. Currently, there are 12 games, such as Bandi, which is aimed at absolute beginners and teaches the basics necessary to play the other games. There's also: GO Copyright © 2025 Vortex Competitions. per pipeline run If you are modding a Steam game, you need to configure Steam to run BepInEx The Gen AI evaluation service in Vertex AI lets you evaluate any generative model or application and benchmark the evaluation results against your own judgment, using your own evaluation criteria. Evaluating Gen AI is integrated within Vertex AI to help you launch and reuse evaluations as needed.

https://www.terabytelytics.com/aviator-pakistan-game-what-to-expect/

The game is known for its high volatility, meaning players can experience both dry spells and massive payouts. With its eye-catching graphics, fun soundtrack, and rewarding bonus features, Sugar Rush 1000 is a must-try for slot enthusiasts looking for a sugar rush of excitement. Connect with us Sugar Rush 1000 takes the original game and stacks it with so much sugary goodness it’s almost too much of a good thing. We offer the most popular games at the click of a button, providing an authentic casino experience from the comfort of your home. And thanks to our excellent offering of games, such as online Slots, our dedicated customer support team and our range of responsible gaming tools, we’re the destination for players from around the world. Untuk bantuan silakan,Klik disini Usually, the visuals in these upgrade slots don’t change a lot, and so it is in Sugar Rush 1000. Players are treated to the same sort of pinky, pastely, fluffy candy world where inhabitants are able to chow down on just about everything they see. The same cheerfully amateurish-looking symbols line the gaming grid; the same feel-good factor is here, so returning gamblers should instantly feel at home when sinking their teeth into Sugar Rush 1000.

Gates of Olympus 1000 destaca por un estilo muy característico y, además, la posibilidad de crear combinaciones ganadoras en cualquier posición de los carretes resulta muy atractiva. Sin embargo, antes de que pases a la acción, te recomendamos que pruebes la tragamonedas en modo demo. Al igual que el título original, Gates of Olympus, Gates of Olympus 1000 viene con un RTP del 96,5%. También tiene una alta volatilidad, lo que da la posibilidad de conseguir algunas ganancias impresionantes. Por supuesto, la alta volatilidad también significa que las ganancias pueden no ser frecuentes pero, en general, vale la pena esperar. COPYRIGHT © 2015 – 2025. Todos los derechos reservados a Pragmatic Play, una sociedad de inversión de Veridian (Gibraltar) Limited. Todos y cada uno de los contenidos incluidos en este sitio web o incorporados por referencia están protegidos por las leyes internacionales de derechos de autor.

http://www.babelcube.com/user/natalie-campbell-1

BC.Game está en nuestra lista de sitios web de apuestas con BTC debido a la flexibilidad del servicio de este operador. Es uno de los pocos que ofrece una casa de apuestas deportivas, casino en línea y lotería en línea en la misma plataforma. Cargar cualquiera de las tres pestañas toma segundos, ¡y desde ahí, comienza el juego! BC.Game tiene mucho que ofrecer a los fanáticos de los juegos de casino. Tiene juegos originales, mesas con crupieres en vivo y una serie de jackpots. Un buen detalle es que tienen una sección para juegos de alta volatilidad. Betpanda.io shines for its crypto-friendly bonus offerings, making it an attractive destination for new and experienced players alike. New users can claim a 100% matched deposit bonus up to 1 BTC, giving a strong start to explore the casino’s vast library of over 5,000 games. This bonus allows players to test popular slots like Gates of Olympus, Sweet Bonanza, and Dead Canary, or enjoy live dealer and table games without risking too much of their own funds.

€3,99 incl. BTW Features zijn er ook in Sugar Rush en daar hebben we gelukkig genoeg over te vertellen. Zo kun je je opmaken voor de volgende Sugar Rush features. Sugar Rush is een alleraardigste online gokkast van Pragmatic Play. Het is geen hele diepgaande gokkast, maar dat hoeft ook niet altijd. De bonusspelletjes vallen vaak en vooral de taartenbonus is erg leuk. 12.500+ tevreden Label Kiki-ladies Hartelijk dank voor je feedback. Dit product is niet beschikbaar. Kies een andere combinatie. Aanvraag voor: Scheepjes Maxi Sugar Rush – 398 colonial rose – Katoen Garen Sugar Rush is een videoslot van Pragmatic Play wat betekent dat er een hoop spellen van deze maker in casino’s te vinden is. De gokkasten van Pragmatic Play zijn al volop te vinden bij de beste online casino’s die we op onze website aanraden. Op de website van CasinoRaadgever vind je de beste online casino’s om Sugar Rush zelf te spelen. Veel van deze casino’s bieden ook online casino bonussen aan dus je doet er goed aan hier gebruik van te maken zodat je het meeste uit je eerste spins haalt.

https://dados.uff.br/ne/user/vesflowsana1973

Money Vault – Maak kans op extra cashprijzen tijdens het spelen. Money Controls table game play at no cost otherwise real cash Leo Vegas slot games today Read More » LCB.org gebruikt cookies om er zeker van te zijn dat je deze website zo goed mogelijk beleeft. Meer informatie ● Weddenschappen die worden geplaatst op spelers die niet deelnemen,worden ongeldig verklaard.● Tenzij anders vermeld tellen verlenging en penalty-shoot-outs niet mee.● De verwerking van markten zal worden bepaald aan de hand van OPTA-gegevens.● Wijzigingen in OPTA-gegevens na het laatste fluitsignaal worden genegeerd. Bekijk hier de 893 casinos casino’s die afgeleid uit 54622 stemmen van onze leden een gemiddelde score hebben gekregen van 2.9 uit 5. Afgeleid uit 1003 stemmen, hebben onze leden een score gegeven van 2.9 aan de 100 spellen gokkasten die we bij LCB hebben gerecenseerd.

В мире азарта, где всякий ресурс стремится заманить заверениями простых призов, рейтинг казино честных

становится как раз той путеводителем, что направляет сквозь ловушки рисков. Игрокам профи да начинающих, что устал из-за ложных обещаний, он инструмент, чтобы ощутить реальную отдачу, как ощущение золотой монеты на пальцах. Без ненужной воды, лишь реальные клубы, где отдача не лишь число, а конкретная удача.Подобрано из яндексовых трендов, как паутина, что вылавливает наиболее свежие тенденции на рунете. Тут отсутствует пространства про клише фишек, любой момент словно ход у покере, там блеф проявляется сразу. Игроки понимают: по стране стиль речи и подтекстом, там юмор притворяется как рекомендацию, помогает избежать рисков.На https://www.don8play.ru/ этот топ ждёт будто готовая раздача, готовый на игре. Зайди, если нужно почувствовать пульс подлинной ставки, минуя иллюзий да провалов. Тем кто любит ощущение приза, он словно взять ставку у ладонях, минуя глядеть в экран.

**mitolyn**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.