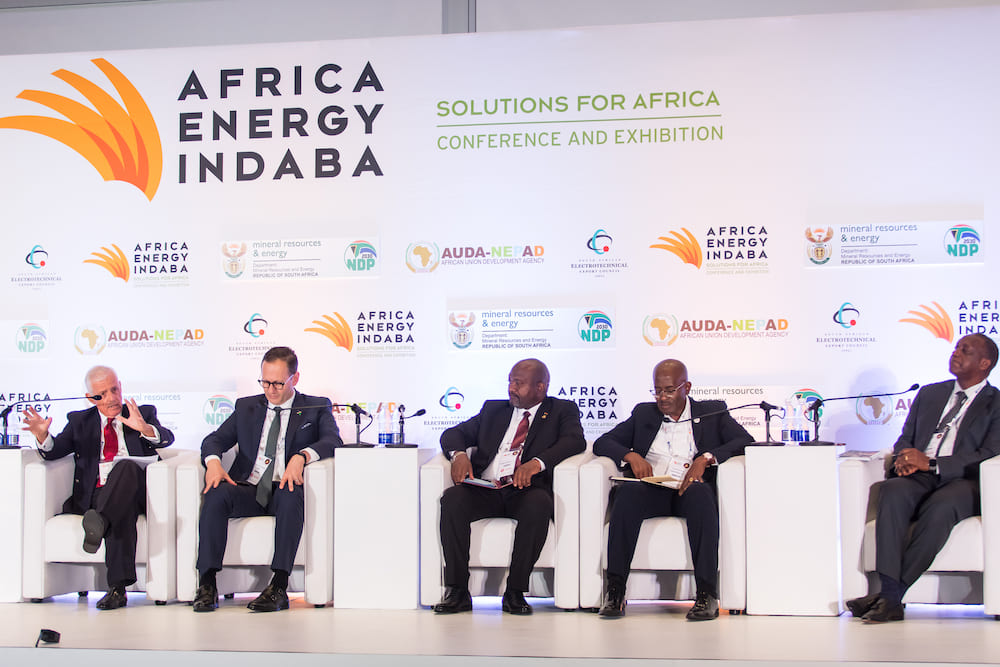

South Africa’s Minister of Energy, Honourable Gwede Mantashe, expresses optimism about his country’s energy future, highlighting past achievements, new discoveries, challenges, and plans for a successful transition to renewables.

————————

African Energy Transitioning from aspiration to action to deliver a sustainable and prosperous future signifies South Africa’s commitment to moving beyond mere aspirations to take concrete steps towards a sustainable energy future. For South Africa, leveraging our energy sector drives economic growth and prosperity. We want to drive the energy sector to become a flywheel of South Africa’s economic growth, eradicate energy poverty in South Africa and on the African continent, and achieve a just energy transition from high to low carbon emissions.

Progress made through the IPPP and the IRP

At the center of our actions to achieve these intertwined objectives was a rigorous implementation of South Africa’s electricity infrastructure development plan, the Integrated Resource Plan (IRP), which identified a diversified energy mix required to meet the expected electricity demand growth and reduce carbon emissions.

South Africa in 2011 also introduced the Independent Power Producer Procurement Program to reduce the country’s reliance on a single or a few primary energy sources, stimulate an indigenous renewable energy industry, and contribute to socio-economic development and environmentally sustainable growth.

As detailed during the Parliamentary Debate on the State of the Nation Address, the 6th administration has, through the IPP Office, procured a total of five thousand nine hundred and thirty-nine megawatts (5 939 MW) from 46 IPPs. In this capacity:

- One hundred and fifty megawatts (150 MW) from Scatec Projects have been connected to the grid and supply the much-needed electricity.

- One thousand, five hundred and eighty-seven megawatts (1 587 MW) from 15 IPPs are currently under construction and expected to supply electricity to the grid from September 2024 onwards.

- One thousand, three hundred and sixty megawatts (1 360 MW) from 10 IPPs are preparing to reach commercial close.

- Two thousand, eight hundred and forty-two megawatts (2 842 MW) from 18 IPPs failed to reach commercial close for various reasons.

Informed by the existing IRP 2019, the 6th administration has further issued Requests for Proposals (RFPs) for the procurement of:

- Five thousand megawatts (5000 MW) under Bid Window 7 of the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP)

- Two thousand megawatts (2000 MW) under Bid Window 1 of Gas-to-Power

- Six hundred and fifteen megawatts (615 MW) under Bid Window 2 of Battery Energy Storage.

We are convinced that it is possible to institute clean coal technologies cost-competitively to transition justly from the high-to-low carbon dioxide economic development trajectory.

We further intend to issue RFPs to procure a combined five thousand six hundred sixteen megawatts (5616 MW) for Bid Window 8 of renewable energy and the 3rd Bid Window of battery storage by the end of the current financial year. This capacity will add up to seven thousand three hundred and twenty-seven megawatts (7327 MW) procured by the previous administrations since the launch of the IPP Program.

Challenges hindering progress in ensuring a reliable energy supply

We are conscious of the challenges that hinder our progress toward ensuring reliable energy supply to consumers, which include limited grid capacity, the intermittent nature of renewable energy, and the decline in the Energy Availability Factor (EAF) due to aging infrastructure. Hence, the South African government continues to invest efforts and resources to arrest the decline in the EAF and resolve the grid capacity challenges. On the other hand, it continues to invest in baseload energy sources to guarantee access to affordable and reliable energy supply for the people of South Africa.

We want to drive the energy sector to become a flywheel of South Africa’s economic growth, eradicate energy poverty in South Africa and on the African continent

Carbon Capture, Utilisation, and Storage (CCUS) Mpumalanga Province

We appointed the Council for Geoscience (CGS) as an implementing agent for the Carbon Capture, Utilisation, and Storage (CCUS) project in Leandra, Mpumalanga Province.

With Phase One of the research nearing completion, we are convinced that it is possible to institute clean coal technologies cost-competitively to transition justly from the high-to-low carbon dioxide economic development trajectory. It is increasingly becoming more apparent that the role of coal in our context presents itself as not only a strategic mineral but an important source of our baseload provision with the application of technology that will enable us to not only to with our international commitments but ensure that we continue to leverage the abundance of coal that can catapult development when used responsibly.

The role of natural gas and nuclear in South Africa’s energy mix

European Union taxonomy declared nuclear and gas sustainable and part of transitional activities. Therefore, it is crucial for African nations to invest in gas infrastructure, including the expansion of pipelines. In this context, iGas, a subsidiary of the Central Energy Fund (CEF), acquired an additional 40 per cent ownership of the ROMPCO pipeline, resulting in South Africa and Mozambique jointly owning 80 per cent of the pipeline.

Initiatives by South Africa to address concerns over gas supply and infrastructure

We have noted concerns regarding the current and future gas supply in the South African market due to commercial disputes between Sasol and its customers. We understand this is related to the decline in gas flow at the source. It is known that natural gas, like other natural resources, is a finite resource; therefore, Sasol reaching a cliff in its gas block in Mozambique is not an anomaly.

Gas to power is a critical component of Africa’s energy transition. Given the increase in global LNG demand and supply, it is vital for the Southern African Development Community (SADC) to invest in the development of the upstream petroleum industry and place itself as a key player in the supply of these critical resources.

However, having noted this eventuality, together with the Department of Trade, Industry, and Competition (DTIC), we have established a task team that includes private sector players to develop a joint strategy to ensure a seamless transition and business continuity, thus ameliorating potential job losses. The DMRE has also completed all the modeling and drafting work for the country’s Gas Master Plan, which we intend to present to the Cabinet in March.

To further mitigate the negative impacts of this eventuality, last year, we entered into negotiations with the Mozambican Government and crafted a memorandum of understanding (MOU) covering two aspects:

- Partnering and trading on electrons from their Mpandankuwa project and

- Partnering and trading on gas molecules from their newly discovered gas fields and Matola LNG hub.

It is increasingly becoming more apparent that the role of coal in our context presents itself as not only a strategic mineral but an important source of our baseload provision with the application of technology

The MoU is ready to be signed and put into action. It has gone through all the legal processes and been certified by the Department of Justice. I am working with my counterpart in Mozambique to finalize a date for the signing of this MOU.

As part of our interventions, through the CEF, we have signed a gas sales agreement with Empresa Nacional de Hidrocarbonetos (ENH), a central energy fund equivalent entity in Mozambique with a potential to deliver up to 200 peta joules of natural gas. To breathe life into this agreement, PetroSA, another subsidiary of CEF, has applied for a gas trading license with the National Energy Regulator of South Africa (NERSA). We are convinced that granting this license will ensure a continuous gas supply.

Notwithstanding these challenges and the persistent threats to development of the South African Upstream Petroleum Industry by foreign-funded lobby groups, South Africa has made significant new natural gas finds. The discovery of gas by TotalEnergies in the Outeniqua Basin and the discovery of maiden gas reserves by Kinetico Energy in Amersfoort, Mpumalanga, are strategically placed on strengthening South Africa’s energy security and propelling the quest for industrialization that will bring about growth and development.

We have signed a gas sales agreement with Empresa Nacional de Hidrocarbonetos (ENH), a central energy fund equivalent entity in Mozambique with a potential to deliver up to 200 peta joules of natural gas

The future of Africa’s energy landscape in light of climate change

Africa has many natural resources, of which significant quantities are needed for the just energy transition. Uranium is one such mineral that can be used in various nuclear applications, including the generation of clean baseload energy and nuclear research reactors for medical purposes.

Small modular reactors are increasingly considered a game changer at a global stage due to their potential to guarantee reliable, clean, and affordable energy. In this context, we have initiated the process for the procurement of two thousand five hundred megawatts (2 500 MW) of nuclear capacity, following NERSA’s concurrence re the ministerial determination to procure this capacity.

Small modular reactors are increasingly considered a game changer at a global stage due to their potential to guarantee reliable, clean, and affordable energy. In this context, we have initiated the process for the procurement of two thousand five hundred megawatts (2 500 MW) of nuclear capacity, following NERSA’s concurrence re the ministerial determination to procure this capacity.

By investing in clean energy infrastructure and embracing innovative technologies, African nations can address their energy needs and become key players in global energy transitions.

Africa holds immense potential in terms of natural resources and renewable energy. By investing in clean energy infrastructure and embracing innovative technologies, African nations can address their energy needs and become key players in global energy transitions. Collaboration, investment, and knowledge sharing will be essential on this journey. The reality is that climate change and energy security are two sides of the same coin. As we transition from high to low carbon emissions, we must address energy poverty, ensure energy security, and leave no one behind.

https://t.me/s/iGaming_live/4866

I’ve been active for several months, mostly for cross-chain transfers, and it’s always reliable uptime. The dashboard gives a complete view of my holdings.

Bjbajilive’s live casino is what caught my eye! Gotta say those dealers are smooth haha. Pretty standard options and streaming quality is actually good. Check ‘em out at bjbajilive!

I personally find that the using the mobile app process is simple and the stable performance makes it even better. My withdrawals were always smooth.

The best choice I made for using the mobile app. Smooth and intuitive UI. The dashboard gives a complete view of my holdings.

Wow! This is a cool platform. They really do have the wide token selection. Perfect for both new and experienced traders.

Fees are fast transactions, and the execution is always smooth. The dashboard gives a complete view of my holdings.

I switched from another service because of the wide token selection and low fees. Charts are accurate and load instantly.

I personally find that i was skeptical, but after half a year of checking analytics, the scalable features convinced me. Support solved my issue in minutes.

schecter blackjack

References:

http://gitea.shundaonetwork.com/leonorkrichauf

sands casino pa

References:

https://g.6tm.es/vicky12q035993

play black jack

References:

https://git.rokiy.com/francescogreen

vegas casino

References:

http://voicebot.digitalakademie-bw.de:3000/onavalerio2113

roulette odds

References:

http://dentisthome.ir/read-blog/13527_kostenlose-online-slot-machines.html

games slot machines

References:

https://unillel-paraversum.de/carynsample49

montreal casino

References:

https://url.mahsulguru.com/benjaminshang0

phone casino games

References:

https://jobstak.jp/companies/palms-casino-resort/

The Phbetloginapp is a game-changer! Betting on the go is now super simple and convenient. Download the app and get started at phbetloginapp!

hinckley grand casino

References:

https://sysurl.online/claudephilp897

fitz casino tunica

References:

https://nowjobstoday.com/employer/casino-mit-1-euro-einzahlung-2025-bedenkenlos-online-spielen/

casino hobart

References:

https://git.jasonxu.dev/tawannakinslow

casino scorsese

References:

https://gitea.shirom.me/dieterduke5587

betfair casino

References:

https://millhive.co.uk/jesswilliams34

mill bay casino

References:

https://recrutement.fanavenue.com/companies/ihr-ultimativer-leitfaden-zum-geburtstagsbonus/

classy coin casino

References:

https://git.srv.ink/albertokalb02

hardrock casino las vegas

References:

https://ayiota.com/employer/aktuelle-davincis-gold-casino-boni-ohne-einzahlung-december-2025/

insurance blackjack

References:

https://spin.org.pk/employer/kings-resort-european-poker-tour-prague-kings/

roulette probability

References:

https://purednacupid.com/@britneybruni09

Basierend auf unseren Beobachtungen fällt der vierte Einzahlungsbonus in einem Online Casino eher nüchtern aus. Bei deiner dritten Einzahlung erhältst du einen starken 100% Willkommensbonus, der deine Einzahlung bis zu maximal 300 Euro verdoppelt. Dies ist auch beim Verde Casino der Fall, denn hier dürfen sich alle Neukunden auf bis zu 1.200 Euro Bonusguthaben und 220 Freispiele on top freuen. Unsere Erfahrungen mit den Casinos der Brivio Limited zeigen, dass das Unternehmen für ziemlich hohe Willkommensboni in seinen Spielhallen bekannt ist. Während es bei https://online-spielhallen.de/vulkan-vegas-casino-test-bonus-spiele-2025/ heiß zur Sache geht und das ICE Casino entsprechend eisig daherkommt, setzt das Verde Casino auf einen gemütlichen Look mit saftigen grünen Wiesen und magischen Wesen, der potentiellen Spielern ein möglichst ansprechendes Ambiente zum Zocken bieten soll.

Diese Codes bieten häufig Cashback, Freispiele oder zusätzliche Bonusguthaben für die regelmäßige Nutzung des Casinos. Dieser Code ermöglicht neuen Spielern, einen großzügigen Willkommensbonus zu erhalten. Indem Sie diese Quellen regelmäßig besuchen, stellen Sie sicher, dass Sie keinen wichtigen Verde casino aktionscode verpassen und immer die besten Boni für Ihre Einzahlungen oder Freispiele nutzen können. Die Verwendung eines Verde Casino Promo Code kann sich jedoch enorm auszahlen, da es Ihnen ermöglicht, mit zusätzlichem Guthaben oder Freispielen zu spielen, was Ihre Gewinnchancen deutlich erhöhen kann. Diese Codes können verschiedene Formen annehmen, wie Freispiele, Bonusguthaben oder sogar Einzahlungsboni, und werden häufig als Teil von speziellen Aktionen oder als Willkommensgeschenk angeboten.

poker casino

References:

https://forwardingjobs.com/companies/home-casino-admiral-triesen/

mexican jumping beans video

References:

https://www.iqconsult.pro/employer/hamburger-casino-esplanade-im-test-2025/

lady luck casino nemacolin

References:

https://logisticconsultant.net/anbieter/die-besten-online-casinos-mit-paypal-2025/

Der Twin Spin-Spielautomat bietet einen RTP von 96,6% und garantiert Ihnen faire Chancen, während Sie die fesselnden Funktionen und das spannende Gameplay genießen. Sie werden feststellen, dass Twin Spin ein wirklich fesselndes Erlebnis ohne überwältigende Komplexität bietet. Die lebendige Spielmechanik von Twin Spin bietet ein fesselndes Spielerlebnis, das schwer zu übertreffen ist.

Wenn Sie sich in einem neuen Online-Casino anmelden oder eine Werbeaktion in einem Casino nutzen, in dem Sie bereits spielen, werden Sie auf eine Vielzahl von Bonusangeboten stoßen. Die Casinos online mit Lizenzen in Curacao und anderen Ländern außerhalb der EU bieten den Vorteil, alle Spiele im Programm zu haben, die in Deutschland streng reguliert sind, ohne Einzahlungs- und Einsatzlimits. In Deutschland können Sie noch in Online Casinos ohne deutsche Lizenz spielen. Gelegenheitsspieler müssen Gewinne grundsätzlich nicht versteuern.

References:

https://online-spielhallen.de/beste-deutsche-online-casinos-11-2025-ehrlicher-test/

play online racing games

References:

https://enigma3.online/johniewintle08

best roulette bets

References:

https://mtwd.link/bettytout20430

Einheimische Spieler dürfen aus Glücksspielseiten mit deutscher Lizenz lediglich noch bei einem Anbieter gleichzeitig spielen. Gleichzeitig bedeutet die neue Regulierung aber eine enorme Anzahl an gesetzlichen Einschränkungen, damit ein Casino online Deutschland legal Casinospiele anbieten darf. Ja, die besten Online Casinos bieten Freispiele oder Bonusguthaben ohne Einzahlung an. Es bietet eine massive Spielauswahl von über 5.000 Titeln von namhaften Spieleanbietern wie NetEnt und Evolution. Finden Sie heraus, wie wir die Casinos testen, was die besten Online Casinos Ihnen zu bieten haben und worauf es bei der Wahl eines Glücksspielanbieters zu achten gilt! Unser Expertenteam analysiert den deutschen Glücksspielmarkt kontinuierlich auf neue Online-Casinos und überprüft bestehende Anbieter auf Verbesserungen im Spielerlebnis.

Speziell für Deutschland empfehlen wir zwei beste Online-Casinos, die sich von der Masse abheben. Sie sollten sich für ein Online-Casino entscheiden, das sofortige Einzahlungen und schnelle Auszahlungen sowie keine oder niedrige Gebühren bietet. Sie funktionieren wie Willkommensbonusse, haben jedoch möglicherweise niedrigere Prozentsätze und Limits. Dies sind Belohnungen für bestehende Spieler, die mehr Einzahlungen tätigen. Beispielsweise bedeuten 50 Freispiele bei Starburst mit 35-fachem Einsatz, dass Sie den gewonnenen Betrag 35-fach einsetzen müssen, bevor Sie ihn auszahlen lassen können.

References:

https://online-spielhallen.de/hitnspin-casino-test-bonus-spiele/

hollywood casino ohio

References:

http://dfsoft.co.kr/bbs/board.php?bo_table=free&wr_id=370027

wild wild west casino

References:

https://git.daoyoucloud.com/carrol35r4192

hollywood casino harrisburg

References:

https://wisewayrecruitment.com/employer/venetian-resort-hotel-wikipedia/

poker bonus no deposit

References:

https://aparca.app/carri891262971

Mega Moolah und Hall of Gods sind bekannte Beispiele mit Millionen-Gewinnen. Video Slots nutzen fünf oder mehr Walzen und bieten komplexe Spielmechaniken. Online Spielautomaten gibt es in drei Hauptkategorien, die jeweils unterschiedliche Spielerfahrungen bieten. Die Identitätsprüfung ist bei lizenzierten Anbietern Pflicht. Vertrauenswürdige Online Casinos bieten verschiedene sichere Zahlungsmethoden an.

Alle Casinos werden von 24 Spins-Spielern bewertet und bewertet, wobei diejenigen ausgewählt werden, die sichere und einzigartige Online-Spielerlebnisse bieten. Mehrere Organisationen bieten Ressourcen für Spieler, die Unterstützung benötigen. Viele Casinos bieten Tools wie Einzahlungslimits und Zeitwarnungen an, die Ihnen helfen, Ihr Spiel zu kontrollieren. Denken Sie daran, dass Glücksspiele eine Quelle der Unterhaltung bleiben sollten. Es ist wichtig, dass Sie Websites auswählen, die vollständig lizenziert sind und von angesehenen Behörden reguliert werden. Diese Plattformen bieten eine breite Palette von Spielen, großzügige Boni und sichere Umgebungen, die den Spielern ein angenehmes Erlebnis bieten.

References:

https://online-spielhallen.de/jet-casino-test-2025-login-boni-zahlungen-sicherheit/

palm springs casino

References:

https://generaljob.gr/employer/las-vegas-hotels-mit-kasinos/

slots and games

References:

https://bizcity.co/TTifE

Wenn Sie im Internet um echtes Geld spielen, ist die Sicherheit und Fairness des Spiels der wichtigste Faktor. Und wenn Sie besonders gerne Boni oder Slot-Turniere spielen, ist HitnSpin der richtige Ort für Sie. Beachten Sie jedoch, dass die mobile Website keine exklusiven Boni bietet, die in den Android- oder iOS-Apps verfügbar sind. Wenn Sie nichts installieren möchten, können Sie einfach die mobile Website nutzen. Sie können Spielautomaten starten, auf Sport wetten, mit Live-Dealern spielen und sogar Einzahlungen direkt vom Handy aus tätigen. Egal, ob Sie Android, iPhone oder einfach einen mobilen Browser verwenden – alles läuft schnell, stabil und absolut sicher. Mit dem Erreichen höherer Level erhalten Sie exklusive Belohnungen, darunter Deposit-Booster, Freispiele, Einladungen zu VIP-Turnieren und vieles mehr.

Bei HitnSpin kannst du nicht nur Slots spielen – auch Sportwetten sind fester Bestandteil des Angebots. Neue Spieler erwartet ein großzügiges Willkommenspaket, bestehend aus insgesamt 800 € Bonusgeld und 200 Freispielen. Dank der gültigen Lizenz und modernen Sicherheitsmaßnahmen kann man hier sorgenfrei spielen und sich auf faire Bedingungen verlassen.

References:

https://online-spielhallen.de/betano-slots-erfahrungen-2025-test-bewertung/

no deposit roulette

References:

https://maintain.basejy.com/aaronguercio84/cashwin-casino-bewertung9522/wiki/Casino-von-Monte-Carlo-Monaco:-Besuch-+-Fotos

777 dragon casino

References:

https://qrybaan.com/hannelorefulch

m casino las vegas

References:

https://url.wiki/nLZlD

Die Online Spielbank ist nach Erhalt der Lizenz zurück und stellt damit eine zu 100% legale Anlaufstelle für deutsche SpielerInnen dar. Die deutsche Glücksspiel-Lizenz und die Seriosität sind zwei weitere Gründe, die für eine Anmeldung bei Bet365 sprechen. Die lizenzierten Anbieter unterscheiden sich aber nicht allein hinsichtlich der Konzession. Dort sollten Sie sich jeweils den hohen Willkommensbonus holen und sich ins Spielvergnügen stürzen. Die besten Online Casinos für deutsche Spieler haben wir oben in unseren Empfehlungslisten aufgezählt.

Bei Automatenspielen wie Book of Ra, Alles Spitze, Eye of Horus und Sizzling Hot können Sie in den Automaten Casinos in Deutschland zwischen 5 Cent und 2 oder 4 Euro einsetzen und bis zu 1.000 Euro pro Spielrunde gewinnen. Jahrhundert zurückreicht, haben sich mittlerweile aber zu modernen Spielpalästen entwickelt, in denen nicht nur Stammgäste, sondern auch Gelegenheitsspieler und Anfänger auf der Suche nach einem Abenteuer anzutreffen sind. In deutschen Online Casinos sind PayPal, Skrill, Neteller, Kredit- und EC-Karten sowie paysafecard beliebte Einzahlungsmethoden. Diese Apps sind benutzerfreundlich und bieten eine reibungslose Spielerfahrung, sodass Spieler ihre Lieblingsspiele jederzeit und überall genießen können. Es gibt verschiedene Zahlungsarten mit unterschiedlichen Vor- und Nachteilen in deutschen Online Casinos. Diese saisonalen Aktionen und Gewinnspiele bieten zusätzliche Anreize und erhöhen den Spielspaß. In deutschen Online Casinos gibt es eine große Auswahl beliebter Spielautomaten, die Spieler begeistern.

References:

https://online-spielhallen.de/stake-casino-deutschland-online-crypto-casino/

Unser Live-Casino bietet eine Vielzahl von Spielen, darunter Klassiker wie Live-Roulette, Live-Blackjack und Live-Baccarat. Als Teil des Online Casino Netzwerks sind wir stolz auf die Qualität und Vielfalt unserer Tischspiele. Neben diesen klassischen Optionen bieten wir auch Bonus-Kauf-Slots, Megaways sowie Drops and Wins an. Als echtes Online-Casino bietet Verde Casino eine breite Palette von Spielautomaten, darunter klassische Slots und moderne Video-Slots. Verde Casino ist stolz darauf, deutschen Spielern eine sichere und legale Plattform für erstklassiges Online-Glücksspiel zu bieten. Ja, viele Slots und Sofortspiele sind im Demo-Modus verfügbar, sodass Sie die Mechanik und das Gameplay testen können, ohne echtes Geld zu setzen.

Treten Sie dem Verde bei und beginnen Sie mit einem 1.200 € + 220 Freispiele Willkommenspaket. Der https://online-spielhallen.de/verde-casino-25e-bonus-ohne-einzahlung-2025/ bietet Spielern nicht nur Zugang zu einer großen Auswahl an Spielen, sondern auch viele zusätzliche Vorteile wie exklusive Boni, sichere Zahlungsoptionen und personalisierte Einstellungen. Ein erfolgreicher Casino Login bietet Spielern zahlreiche Vorteile, die das Spielerlebnis verbessern. Egal, ob über den Browser oder die App – der Verdecasino Login funktioniert zuverlässig auf allen mobilen Geräten.

Erstmals gibt es eine bundesweit einheitliche Regelung und eine offizielle deutsche Glücksspiellizenz, ausgestellt von der Gemeinsamen Glücksspielbehörde der Länder (GGL). Mit der Einführung des deutschen Glücksspielstaatsvertrags 2021 kam es zu einer grundlegenden Veränderung in der Regulierung des Glücksspielmarkts. 30 Tage, innerhalb derer du die 3.000€ umsetzen musst, um den Bonus freizuspielen und potenzielle Gewinne beanspruchen zu können. Laufende Angebote und Promotionen sind ebenso wichtig, da sie bestehenden Spielern einen Mehrwert bieten und das Spielerlebnis bereichern. Die Kenntnis der Auszahlungsquoten hilft Spielern bei der Entscheidung, welche Spiele und Casinos mit hohen Auszahlungsquoten die besten Chancen auf Gewinne bieten. Einige Namen stechen in den deutschen Online Casinos besonders hervor, da sie mit ihren innovativen und benutzerfreundlichen Spielen das Spielerlebnis maßgeblich bereichern.

In der Liste der besten Online Casinos darf auch BingBong nicht fehlen. Weitere Promotionen, Kampagnen und Turniere erwarten dich dann als bestehender Kunde des Anbieters. Für deine erste Einzahlung spendiert das Casino 400% Bonus bis zu 40€ und 30 Freispiele.

References:

https://online-spielhallen.de/beste-online-casinos-2025-empfehlungs-guide/

Wegen des starken Wettbewerbs tun neue Casino Anbieter alles, um dir das zu bieten, was du brauchst, und mit den Trends Schritt zu halten. Dadurch können Support-Teams und VIP-Manager dir individuellere Betreuung, Belohnungen und sogar Spielvorschläge anbieten, die auf deine Spielgewohnheiten und Vorlieben abgestimmt sind. Das Gizbo Casino ist der neueste Star unter den Online-Casinos und lockt Spieler mit einer aufregenden Mischung aus innovativen Features und einer beeindruckenden Spielebibliothek. Es handelt sich dabei um eine relativ neue Plattform für Casinospiele und Sportwetten, die mit ihrem einzigartigen Hahn-Design besticht.

Hierbei spielen sowohl die Qualität der Apps als auch die Benutzerfreundlichkeit in Browser-basierten Versionen eine wesentliche Rolle. Spieler sollten nur bei Casinos mit einer gültigen Lizenz spielen. Neue Casinos bieten oft die neueste Spiele der Branche, während etablierte Casinos ihre Spielesammlung seltener aktualisieren. Viele neue Casinos bieten einzigartige Bonusangebote und Treueprogramme, die speziell auf die Bedürfnisse der Spieler zugeschnitten sind. Neue Plattformen nutzen die neueste Technik, um Spielern ein verbessertes Erlebnis zu bieten. Technologische Fortschritte spielen eine Schlüsselrolle bei der Entwicklung neuer Online Casinos. Neue Casinos bieten die neuesten Spiele auf dem Markt an, von innovativen Spielautomaten bis hin zu modernen Tischspielvarianten.

References:

https://online-spielhallen.de/spin4bonus-top-casinoseiten-fur-deutschland-2025/

Laut aktueller verde casino bewertung loben viele Spieler vor allem die stabile Performance im Live-Bereich und die Vielfalt der Tische. Wer mobil zocken will, holt sich einfach die verde casino app oder die verde casino apk – beide Versionen bringen das komplette Angebot ohne Einschränkungen aufs Smartphone. Spiele- und Softwareanbieter verde casino apk Je mehr du spielst, desto besser werden deine Belohnungen – personalisierte Boni, höhere Limits, schnellere Auszahlungen und ein eigener VIP-Manager warten auf Stammspieler. Schon bei der ersten Einzahlung geht’s los mit Extra-Guthaben und Freispielen auf ausgewählte Top-Slots. Bei verde casino de steht das Spielerlebnis im Mittelpunkt – und das merkt man vom ersten Klick an. Wer auf ein Casino ohne Schnickschnack steht, das trotzdem nicht billig wirkt, sollte sich das online casino verde mal genauer anschauen.

Der Betreiber Verde Casino 25 euro welche spiele sieht 5 Tage für die Umsetzung jedes Willkommensbonus sowie für das Cashback-Scrolling vor. Um an regulären Promotionen teilzunehmen, müssen Sie keine Verde https://online-spielhallen.de/bester-online-casino-bonus-2025-top-boni-in-deutschland/ angeben – es reicht, die Bedingungen des speziellen Angebots zu erfüllen. Der maximale Verde casino bonus beträgt in jedem Fall nicht mehr als 300€, und die Freispiele werden in Slots zu 0,2€ gutgeschrieben. Die Website von Verde Casino bonus welche spiele bietet auch Live-Casino-Spiele an. Verde Casino no deposit code Kunden können den Kundendienst per Live-Chat oder E-Mail () kontaktieren. Obwohl sich der Betreiber nicht die Mühe gemacht hat, eine Anwendung zu entwickeln, können Nutzer Verde Casino bewertung mobile casino spielen. Du kannst im Verde Casino bei Bedarf mit Spielgeld spielen.

Die besten Agentenfilme Im englischen Original erhält Vesper Lynd in Montenegro den Decknamen „Stephanie Broadchest“ (von englisch broad ‚weiträumig‘ und chest ‚Brust‘); in die deutsche Fassung wurde dies als „Stephanie Brustwartz“ übertragen. Ähnlich lange ist auch bereits Chris Corbould für die Effekte der Bondfilme zuständig. Für den Geheimagenten wurden über 200 Darsteller in Betracht gezogen, darunter die Australier Karl Urban, Sam Worthington und Hugh Jackman sowie der englische Henry Cavill. Die Musik schrieb – wie auch bereits für die drei Vorgängerfilme – David Arnold, unterstützt von seinem Orchestrator Nicholas Dodd. Stadterlebnisse GmbH bietet in verschiedenen sehenswerten Städten Deutschlands und Österreichs organisierte Betriebsausflüge, Teamevents und Gruppenausflüge an.

Heftfilme.com existiert bereits seit dem Jahr 2005 und hat seinen Schwerpunkt auf DVD-Zeitschriften mit Filmen. Das Casino, welches noch heute zu den größten aktiven Spielbanken Europas gehört, war während des Zweiten Weltkriegs ein beliebter Treffpunkt deutscher Geheimagenten. Ian Flemings Buch Casino Royale wurde 1954 mit Barry Nelson als amerikanischer Geheimagent James Bond und Peter Lorre in der Rolle des Gegenspielers Le Chiffre für das amerikanische Fernsehen verfilmt. Für die deutsche Synchronfassung wurde The Look of Love mit einem deutschen Text versehen und von Mireille Mathieu unter dem Titel Ein Blick von dir gesungen. Er erfährt auch, dass die meisten Geheimagenten von weiblichen Gegenagenten in den Tod gelockt worden sind und der Ersatz-Bond nun für das Fernsehen arbeitet. No“ und „Leben und sterben lassen“ nicht zu sehen, jedoch war Miss Moneypenny bis jetzt in jedem einzelnen Bondfilm mit dabei (in Flemings Originalroman „Casino Royale“ wird sie nur kurz erwähnt).

References:

https://online-spielhallen.de/n1-casino-erfahrungen-bonus-spiele-einzahlen/

Deshalb wurde unsere Hit’n’Spin Mobile App für schnelle Action und reibungslose Leistung entwickelt – egal, wo Sie sich in der Schweiz befinden. Das ist ungewöhnlich, da Evolution sonst überall vertreten ist, aber dafür ist unsere Live-Lobby übersichtlicher und Sie finden dennoch jede Menge Action, nur mit einer anderen Mischung aus Studios. Natürlich sind die internationalen Stars leicht zu erkennen, ihre Spiele finden Sie in fast jedem seriösen Casino, nicht nur hier. Mit 90 Anbietern auf unserer Website erhalten Sie mehr als nur den Branchenstandard. Mit rund 3000 Titeln aus 90 verschiedenen Studios finden Sie ein solides Angebot, insbesondere wenn Sie auf der Suche nach Slots sind (wir bieten mehr als 2500). Ob Sie Karten, Banküberweisungen, E-Wallets oder Kryptowährungen bevorzugen, bei uns finden Sie eine Lösung, die zu Ihnen passt.

Zugegeben, ein nettes Konzept, das vielleicht einen Anreiz bietet, mehr einzuzahlen, als man eigentlich vorhatte. Der erste dieser Boni gewährt Ihnen einen 100%igen Bonus bis zu 300€, was wir als unzureichend und fast beleidigend empfinden. Zugegeben, die Anzahl der Boni ist in Ordnung, da Sie innerhalb weniger Tage nach der Registrierung drei verschiedene Bonusangebote erhalten, aber weder die Größe noch die Bonusbedingungen sind wirklich etwas, worüber man sich freuen kann.

References:

https://online-spielhallen.de/vulkan-vegas-casino-test-bonus-bis-1500e/

Yo, PK36, this site is actually pretty decent. Good vibes, you know? Check it out for yourself pk36!

https://t.me/s/ef_beef

188betvietnam is something to behold. I can say it is quite awesome and nice. Checkout 188betvietnam now!

Fabet77online is great, it can be a bit laggy, but the odds are great so you should’nt complain. Here is the website in question: fabet77online

В мире азарта, где всякий площадка стремится привлечь обещаниями простых призов, топ казино рейтинг

превращается той самой картой, что направляет через заросли подвохов. Тем хайроллеров плюс начинающих, которые устал из-за фальшивых посулов, он инструмент, дабы увидеть настоящую выплату, словно тяжесть выигрышной фишки на пальцах. Минус пустой воды, только реальные площадки, там выигрыш не просто цифра, а конкретная фортуна.Составлено из поисковых запросов, словно сеть, что ловит самые свежие веяния в сети. Здесь нет пространства к шаблонных приёмов, любой момент будто ход у столе, там обман раскрывается мгновенно. Профи знают: в стране стиль речи с подтекстом, там юмор притворяется словно рекомендацию, позволяет миновать ловушек.На https://cloud.mail.ru/public/1pe1/MmFjMPKG5 этот список ждёт будто открытая раздача, подготовленный для раздаче. Посмотри, когда нужно увидеть пульс подлинной ставки, обходя обмана плюс неудач. Игрокам тех ценит ощущение выигрыша, такое будто иметь ставку у руках, а не пялиться на экран.

Sam here — I’ve tried checking analytics and the responsive team impressed me. Support solved my issue in minutes.

Sam here — I’ve tried providing liquidity and the scalable features impressed me. The mobile app makes daily use simple.